What if every e-commerce website was just a tiny Amazon marketplace? With fast Prime shipping, free returns, and one click checkout…

What if I could checkout with Amazon Pay from any physical grocery store, shopping mall, restaurant, or entertainment venue?

If Amazon has it their way, that's the Prime future you can imagine!

In this week's 66th Edition of the Shopifreaks newsletter, I cover Amazon's new Buy with Prime feature for e-commerce websites, as well as their new Small Business badge.

I also report on Shopify's planned acquisition of Deliverr, Visa and Mastercard's interchange rate hike, some funny business with Indian logistics companies, and a brief history into One Click Checkout's proprietary past.

All this and more in this week's edition of the Shopifreaks newsletter. Thanks for being a subscriber.

Stat of the Week

BMW aims to sell 25% and Volvo 50% of its cars online by 2025. 38% of surveyed current car shoppers plan to buy their next car online. Prior to the pandemic, only 2% of cars were bought online. — According to Forbes, ABC News & Cars.com. –> [RETWEET IT]

1. Buy With Prime coming to websites near you

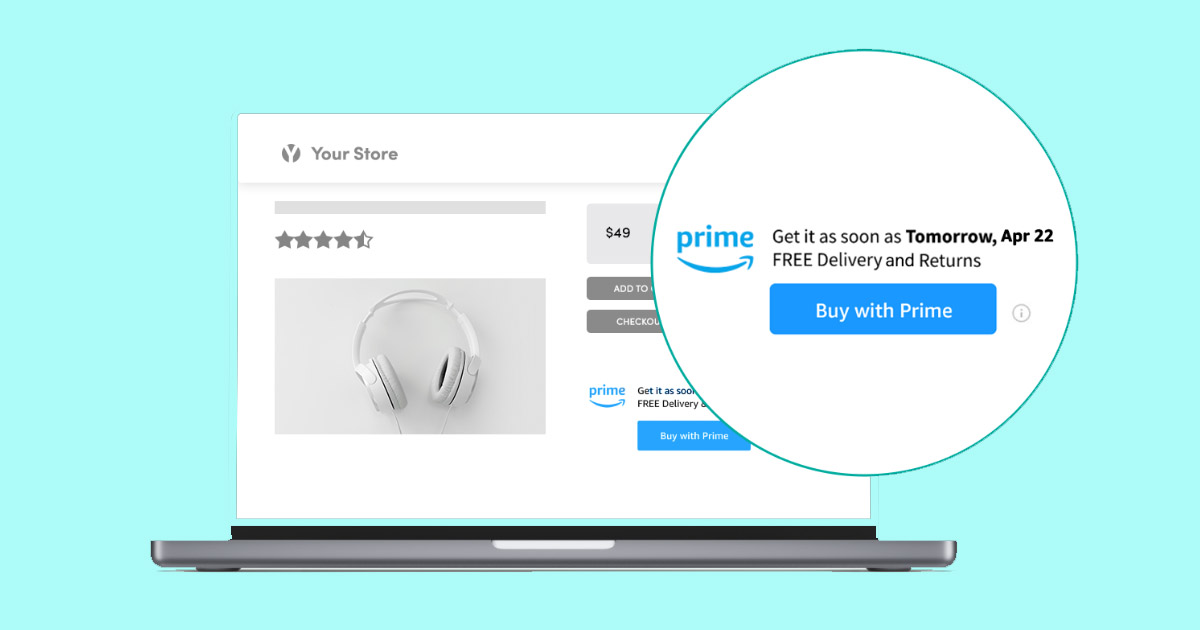

Amazon has announced Buy with Prime, a new feature that allows select Amazon merchants to sell their products directly from their own websites, while still offering Prime shopping benefits like fast, free shipping, quick checkout with Amazon Pay, and free returns.

In other words, it's like shopping on Amazon, but on another website.

One requirement, however, is that the website has to fulfill their items through the Amazon FBA program–but that makes sense. Otherwise, how would Amazon be able to guarantee fast turnaround and shipping?

Participating websites will display the Prime logo and expected delivery date next to their products, and the checkout will happen on their store, but Amazon will fulfill the orders and manage the free returns for the seller.

The service will initially be available by invitation only for merchants using FBA. Those select merchants can add Buy with Prime to their store and start selling in minutes since their inventory is already stored at Amazon fulfillment centers.

The VERY first question I had when I read about this program was — does the website get ownership of their customer? Or will Amazon hide the customer information, as if they bought it on their marketplace? And the answer is, YES, the merchant will receive the customer order information including their e-mail address, and websites can add those customers to their existing post purchase sales funnels.

Amazon has not disclosed how much the service costs, other than to indicate that it'll be variable rates, just like their fulfillment services. On their Merchant FAQ page they said:

“Buy with Prime’s cost per unit will depend on multiple factors, including product dimensions and weight, average selling price and number of units per Buy with Prime order. The cost includes fulfillment, storage, payment processing, and service fees that are calculated per unit. The cost of returns is included in the fulfillment fee. Merchants pay for what they use, and all fees, except for those incurred for storage, are charged only after merchants make a sale. Upon being invited to the program, our sales team will explain the pricing in detail.”

One other thing I thought was cool about the service is that sellers DO NOT have to sell on Amazon.com marketplace in order to use Buy With Prime on their websites. However at the beginning, it's invite only exclusively to FBA sellers, so all initial users will also be merchants who sell on the Amazon marketplace.

I think this is a great new feature for merchants and a win for Amazon. Once this feature rolls out to the masses, the Amazon brand will instantly appear on hundreds of thousands of independent seller websites. It'll be like an Amazon Army of 3rd party e-commerce soldiers waving their Amazon flags in exchange for Prime shipping.

I'll be curious to learn how much the fees are and how they compare to current fulfillment fees.

For example, I sell my World Map Coloring Posters on TravelisLife.org and on Amazon.com, and Amazon fulfills the orders from both channels.

When I sell the maps on Amazon.com, they take a $2.55 sales commission (ie: 15% of the sales price) and a $2.92 FBA fee for a total of $5.47.

When I sell maps on TravelisLife.org, they charge me $3.99 to fulfill the order. And I pay my own merchant processing fee since I handle checkout. This is a sweet deal for me because it costs me around $4.57 + packaging to ship the maps myself. (And I'm usually out of the country, so fulfillment would be tough!)

With the Buy with Prime feature, I speculate that the total fee will be somewhere in between the two figures above, since Amazon will be handling both the merchant processing through Amazon Pay and the fulfillment through FBA.

In September 2021, I reported that Amazon is developing a new type of POS system that can handle both online and offline transactions as well as link to other Amazon services including Prime membership, Amazon One hand-scanning biometric payment solutions, and Flex delivery.

Buy with Prime and their POS will position Amazon to completely power small businesses retail commerce, both online and offline, from sale to fulfillment.

Should we be in awe or nervous about that? Hit reply and let me know your thoughts.

2. Speaking of Amazon and small businesses…

Amazon is looking to make it easier for you to know when you're buying from a small business, which account for over 50% of their marketplace sales. The company began testing a “Small Business” badge to identify products sold from third-party sellers that meet its definition of a small business.

Amazon is still in the process of deciding which items to show the badge on, and they are currently not taking requests. (Show it on Travel is Life products! I'm a small business!)

Amazon also plans to add additional discoverability features in the future, like the ability to search specifically for small business sellers.

In March, I reported that Google Shopping unveiled a filter to show visitors products sold in “smaller stores”. The feature was announced last year and recently started to roll out in the U.S.

Every big tech company wants us to know how much they love small businesses!

It'd be hilariously off-brand if Etsy, the self proclaimed “global marketplace for unique and creative goods”, made a Small Business badge next! As you might recall, thousands of Etsy sellers went on strike earlier this month, and one of their complaints was that the platform, which used to cater to small independent creators and sellers, has now been overrun with big sellers and mass-produced print-on-demand products.

3. Shopify may expedite its fulfillment goals by acquiring Deliverr, but it'll be costly

Shopify is in talks to buy the e-commerce fulfillment company, Deliverr, in a deal that could value the startup between $2.3B to $2.7B. Deliverr was most recently valued at $2B as of its $250M Series E round in November.

In February, I reported that Shopify President Harley Finkelstein unveiled plans spend $1B over two years, starting in 2023, to greatly increase the number of company-owned warehouses, with the end-goal of being able to offer two-day or less delivery to over 90% of the US population.

The acquisition of Deliverr would certainly expedite that goal, but would cost Shopify around 2.5x of its intended budget. Deliverr currently has 80 warehouse locations across the US, 2 cross-docks, 5 sortation centers, and 12 carriers to power 2-day and next-day delivery.

Equally important as the infrastructure, Deliverr has got the logistics technology in place too, which is a big deal for Shopify.

Insiders to the company have previously said that the real challenge for Shopify lies in the software. Shopify’s acquisition of the robotics startup, 6 River Systems, a few years ago was supposed to provide the software foundation for their fulfillment network, but insiders close to the project have said that the work to build and integrate the central warehouse management software is still in progress, and that it’ll likely take years for the software to have the type of functionality that shareholders expect.

If Shopify purchases Deliverr, they'll have that working logistics software overnight.

News about the potential Deliverr acquisition, Amazon's Buy with Prime announcement, and a general downward swing in the market particularly across FAANG stocks hit $SHOP hard. The stock dropped over 17% last week to hit a 52-week low of $454.03.

I reported two weeks ago on Shopify's proposed 10:1 stock split. If it drops any further, the split might turn it into a penny stock! (I shouldn't make jokes. I own way too much $SHOP. I'm still super long on it though despite the dip. I'll never sell!)

4. Did you know that One Click Checkout was patented for 18 years by Amazon?

One click checkout has been in the news a lot lately as companies battle it out for market share.

- This week I'm reporting on Amazon's new Buy with Prime service which works in conjunction with their Amazon Pay.

- Two weeks ago I reported on Fast closing its doors.

- Bolt's CEO has gotten a lot of attention lately after ruffling some feathers in the e-commerce world.

- And of course I'm regularly talking about Shop Pay, Facebook Pay, PayPal One Touch, Apple Pay, Bold Checkout, WhatsApp Payments.. LOL did I miss any? (I definitely did.)

With all the attention in recent years on one click checkout services, some of you may not remember that up until 2017, Amazon held the patent to this simple technology. Here's a brief history by Business Insider of the evolution of one click checkout.

- Sep 1999 – Amazon patented its 1-Click checkout tech

- Oct 1999 – Amazon sued Barnes & Noble, alleging that its Express Lane online checkout system infringed on its patent.

- 2000 – Apple signed a licensing agreement with Amazon to use its 1-Click checkout in its online store in exchange for an undisclosed annual fee

- 2002 – A judge issued an injunction preventing Barnes & Noble from using a one-click system, so they had to switch to a two click checkout

- 2014 – PayPal rolled out its One Touch feature which allowed customers to make payments without having to re-enter their login credentials

- 2015 – Bolt checkout starts raising money for its one click checkout

- 2017 – Amazon's patent expired

- 2017 – Shopify launched Shopify Payments (now Shop Pay)

- Feb 2018 – WhatsApp launches WhatsApp Pay

- Nov 2019 – Facebook introduces Facebook Pay

Next up, Amazon is patenting their new “No Click Checkout”, which uses AI to predict your buying habits and makes purchases for you on your behalf. (LOL. I shouldn't give them any ideas!)

5. Visa and Mastercard are raising their interchange fees

Interchange fees (sometimes called swipe fees) are what merchant processors are charged each time they transact a debit or credit card transaction. They are kind of like the wholesale rate that payment processors pay Visa and Mastercard, which they then tack on additional fees to charge their merchant clients.

Both Visa and Mastercard are raising their interchange fees this month. The fee increases were originally scheduled to take effect in April 2021, but were postponed due to COVID.

Companies that mostly have B2B transactions will see a bigger increase to their fees than B2C companies, but both will see fee increases.

On Monday, the National Retail Federation (NRF) urged the payment providers to cancel the scheduled swipe fee increases. According to the NRF, the fees drive up consumer prices and will cost the average American family more than $700 a year.

Several US Senators and House of Representatives members also sent a letter to Visa and Mastercard asking that they withdraw their plans. They wrote, “Your profits are already high enough and any further fee increase is simply taking advantage of vulnerable Americans.”

Mastercard responded by saying that they haven't raised rates in over a decade.

However I think that response is a bunch of baloney. The reality is that Visa and Mastercard have no reason to raise their fees because they get an automatic raise every year as prices naturally go up from inflation.

Let's say that the average interchange fee is 1.4%. That means Visa makes $14 on a $1000 purchase. Next year, when that $1000 product costs $1085 due to inflation, supply chain issues, corporate greed, or whatever else is driving up the cost of consumer goods right now, Visa makes $15.19 on the transaction, an 8.5% increase.

Both companies had record profits last year and beat forecasts and investor expectations. To increase their fees is considered by some to be an abuse of their position and the 80% market share that they collectively hold. Their profits are essentially a tax on American businesses that gets passed onto consumers, and they should tread lightly with fee hikes if they'd like to continue to operate unregulated in regards to how much they can charge.

Earlier this year I reported on Amazon's threat to stop accepting Visa credit cards in Britain on account of their high fees, which Amazon moved forward with. A month later, the two companies reached an undisclosed agreement to continue operations together. Too bad Amazon didn't throw some of their weight to help the rest of us!

6. A massive logistics price hike in India

As if dealing with an increase in interchange fees wasn't enough, some business owners in India are also experiencing a sudden spike in logistic and fulfillment service fees.

India's three largest logistics firms, Delhivery, Ecom Express, and Xpressbees, have come together and simultaneously increased shipment charges as much as 50% for orders received online from aggregators such as Shiprocket, Pickrr, Shipyaari and others.

The price hikes were more tactical than financially necessary, as the logistics companies found that aggregators were offering better per-shipment delivery prices than their own rates for enterprise clients.

LOL so rather than make their Enterprise packages more attractive, they hiked their prices up so that the aggregators' rates became less competitive.

Sources said the logistics firms were spooked by some of their enterprise clients being wooed by aggregators with cheaper rates.

Interestingly, the increase in rates for aggregators also came at a time when many of them are also in various stages of talks to raise new funds at increased valuations.

So what's it called when major players come together and corroborate a price increase? I'm fixing to remember the word… it's on the tip of my tongue….

7.Stripe and Twitter go crypto

In March, I reported that Stripe was bringing back support for crypto businesses including exchange on-ramps, wallets, and NFT marketplaces. Stripe was was one of the first big fintech companies to embrace Bitcoin in 2014, but it stopped processing BTC transactions in April 2018 on account that crypto currency “became less helpful for moving funds”.

Announced last week, the first company to sign up is Twitter, which through a partnership with Stripe, will enable a select group of creators to receive revenue they generate using its monetization features as cryptocurrency.

The new cryptocurrency payment support will become available as part of Stripe Connect, which will initially enable participating companies to pay users in USDC, a stablecoin pegged to the U.S. dollar. The payments will be processed using the Polygon network, a sidechain that connects to Ethereum.

Stripe plans to add support for additional cryptocurrency payment methods through Stripe Connect to more than 120 countries by year’s end.

8. Other e-commerce news of interest this week

- Shanghai's market regulators summoned 12 e-commerce platforms, including food delivery platforms Meituan and eleme.me, to discuss price gouging during the pandemic. The regulator told platforms to improve the way they manage delivery riders and curtail practices like improper price increases by riders.

- Shopify CEO Tobi Lütke dropped from 2nd to 11th on Canada's richest persons list. His personal fortune, mostly comprised of Shopify stock, reached more than $10B last year, but has since cut in half. He now sits at #552 overall on Forbes’ list – 320 spots below his ranking from a year ago.

- BigCommerce and Avasam, a dropshipping marketplace, are teaming up to launch Click2Launch, a direct dropshipping integration that will offer pre-installed themes and pre-loaded products on the BigCommerce platform. The new service will automate ecommerce functions such as order processing, inventory synchronization, payment and shipping.

- After two years of litigation, Reliance Industries has scrapped its plan to buy the Indian retailer, Future Group, which runs the country's biggest retail grocery chain. Amazon has fiercely contested the $3.2B takeover, arguing that contractually it had the first right of refusal to buy Future.

- Jack Dorsey, the CEO of Block, will be changing his title from CEO to Block head and chairperson. The title change will not come with any change to his roles or responsibilities. In other news, I'm changing my position at Shopifreaks from Editor to Galactic President Superstar MacAwesomeville.

- Amazon's plans to build a crazy looking 350′ tall helix-shaped tower as the centerpiece to its second headquarters were approved by the Arlington County Board in Northern Virginia. The blueprints also include a child-care facility, 2.75 acres of open space, retail, and three office buildings. Click that link above and look at the mockup of the building. It's wild!

- Zappos, which is owned by Amazon, named Amazon executive Ginny McCormick as its first chief marketing officer in its 23-year history. Amazon bought Zappos for $1.2B in 2009 but let the company run autonomously under its former CEO, the late Tony Hsieh who passed away in 2020.

- A second Amazon fulfillment center on Staten Island is set to hold their own union vote today which will continue through Friday, following a 2,654 to 2,131 union victory in the JFK8 vote last month. Votes will be cast via secret ballot inside a tent with monitoring by the National Labor Relations Board.

- Kredivo, an Indonesian BNPL platform, launched its Infinite Card in collaboration with MasterCard, a virtual card that can be used to pay on all e-commerce and online platforms. The card carries the same interest rate as their BNPL service – 0% for 30 days and 3 month installments and 2.6% per month for 6- and 12-month installments.

- Coinbase announced the long anticipated launch of its Coinbase NFT marketplace, which is now available in beta test mode. A small group of beta tester are being invited based on their position on the waitlist and others will be added over time. The marketplace currently only supports Ethereum-based NFTs and payments in ether, but will look to add additional crypto and fiat payment options in the future.

9. This week in seed rounds, IPOs, & acquisitions….

- Shopify has made a significant investment in Crossing Minds, an AI recommendation platform that enables merchants to leverage individualized recommendations that engage and convert customers without cookies or personal data. As part of the deal, the software will become available to Shopify merchants. This is Shopify's first investment in an AI-powered recommendation platform

- Zubale, a Mexico City-based marketplace for software and gig collaborators, raised $40M in a Series A round led by QED Investors. The company will use the new funding to invest in its technology development, build operations in Brazil and Chile, and launch embedded finance products and services.

- Goat Brand Labs, a Bengaluru-based e-commerce brand aggregator, raised $50M through convertible share warrants, at a capped valuation of $250M. Incoming investors will be able to convert these warrants into equity shares when the company closes its next round of funding. The company is thinking of kicking off a new funding round in the next quarter to raise around $100M.

- AppHub, a startup that builds and acquires apps developed for online seller marketplaces like Shopify, BigCommerce, Magento, and WooCommerce, launched on Thursday with $60M in funding from Silversmith Capital Partners. AppHub has 20 apps on its platform so far, including its recent acquisitions of Orderbump and ViralSweep, and will use the funding to acquire and build more apps.

- Rooser, a marketplace for sourcing fish, raised $23M in a round led by Index Ventures, bringing its total amount raised to $26M at an undisclosed valuation. The company currently offers 45 species and will use the funds to expand into more markets and continue building more functionality into its platform.

- SEON, a London-based startup that powers online fraud prevention for companies like Revolut, NuBank, Afterpay, Patreon, Sorare and mollie, raised $94M in a Series B round led by IVP. The company will use the funding to make their product faster, expand globally into LatAm, APAC, and the US, and create 1-click integrations for small retailers.

- Amazon acquired GlowRoad, an Indian social commerce firm that sells products to customers at wholesale prices and helps them resell on Facebook and WhatsApp, in an all-cash-deal for an undisclosed amount. The acquisition will help Amazon make inroads with its commitment to digitizing India's 10M businesses by 2025.

- Convoy, a digital freight network that connects shippers with carriers, raised $260M in a Series E round consisting of $160M in equity led by Baillie Gifford and T. Rowe Price and $100M in venture-debt from Hercules Capital, as well as a $150M line of credit from J.P. Morgan, bringing their valuation up to $3.8B. Part of the funding will go toward expanding their drop-and-hook service that allows shippers to pre-load Convoy trailers and set them aside so truckers can pick them up during more flexible windows, and the rest will go towards growing its team and tech.

- Jarvis ML, a platform that offers an AI-powered personalization engine to brands selling products, services, and experiences, raised $16M in a round led by Dell Technologies Capital. The company will use the funding to grow their R&D, sales, and marketing teams to accelerate product development. And I assume part of that funding will be used for legal fees and rebranding after Disney sues them for using the name “Jarvis” (like they did the copywriting AI software company earlier this year).

- Morado, a two-month old Colombian marketplace for the beauty industry that aims to digitize beauty salons in Latin America, raised $5M in a pre-seed round co-led by Tiger Global Management and H20 Capital Innovation. The company's goal is to reinvent the current supply chain through vertical software technology and next-day deliveries and plans to use the funding to accelerate its growth in Colombia before moving onto Mexico.

- Vaayu, a platform that offers real-time monitoring of retail sales to help retailers reduce their carbon footprint, raised $11.5M in a round led by Atomico, bringing their total amount raised to $13M. The new funds will allow the company to offer retailers emissions benchmarking against their peers and detail the carbon footprint of individual items.

- SaveIN, an Indian BNPL product that breaks elective healthcare procedures into more affordable payments, raised $4M in a round led by 10X Group, Leonis VC, and Goodwater Capital. The company will use the funds to develop its product, hire new employees, and address its branding.

What'd I miss?

Shopifreaks is a community effort and I appreciate your contributions to help keep the rest of our readers in the know with the latest happenings in e-commerce. Whenever you have news to share, you can e-mail [email protected] or hit reply to any of my newsletters.

You can also mention @shopifreaks on Twitter or submit posts to r/Shopifreaks on Reddit, and I'll curate the best submissions each week for inclusion in the newsletter.

💖 Thanks for being a Shopifreak!

If you found this newsletter valuable, please share it with your colleagues and help us grow.

See you next Monday!

PAUL

Paul E. Drecksler

www.shopifreaks.com

[email protected]

PS: Why can’t a nose be 12 inches long? … Because then it’d be a foot.

PPS: Don't forget to show me some love on Google and Product Hunt. Thanks!